本笔记直接从 Notion 签出,内容不全,格式混乱,内容或有错误,仅供参考

本文 All Right Reserved 保留所有权利,禁止商用和任何形式的转载!

Unit 2: Economic Indicators and the Business Cycle

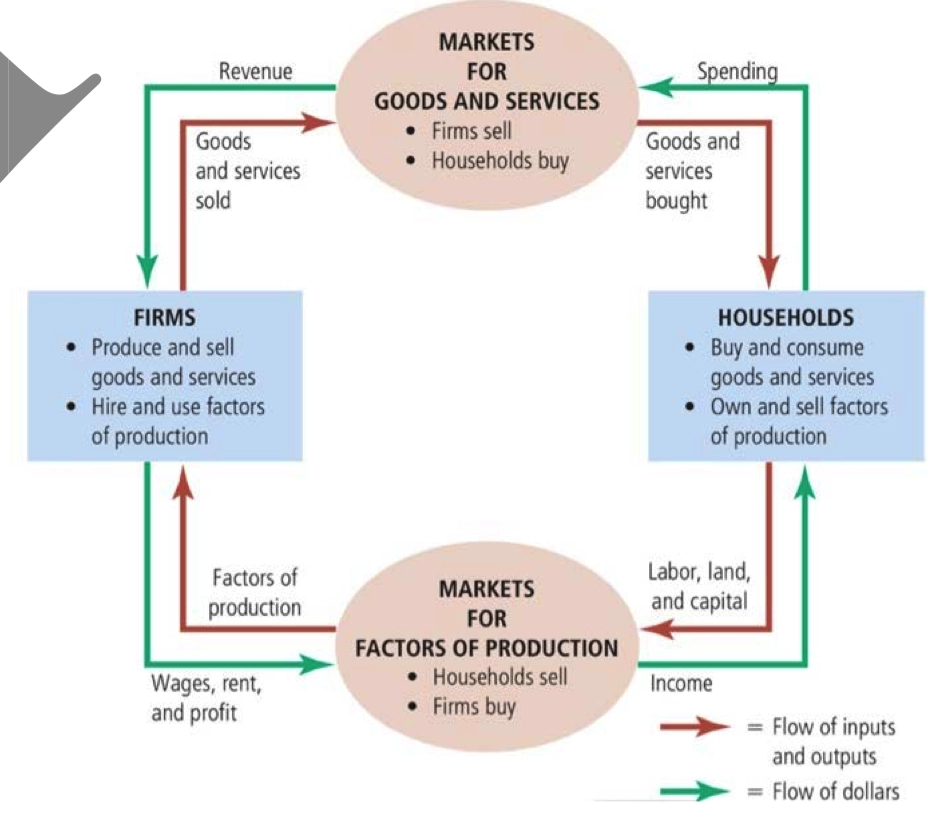

Circular Flow Diagram

- 买方市场

- 商品服务,Firm 卖,Household 买

- 卖方市场

- 人力资源,Household 卖,Firm 买

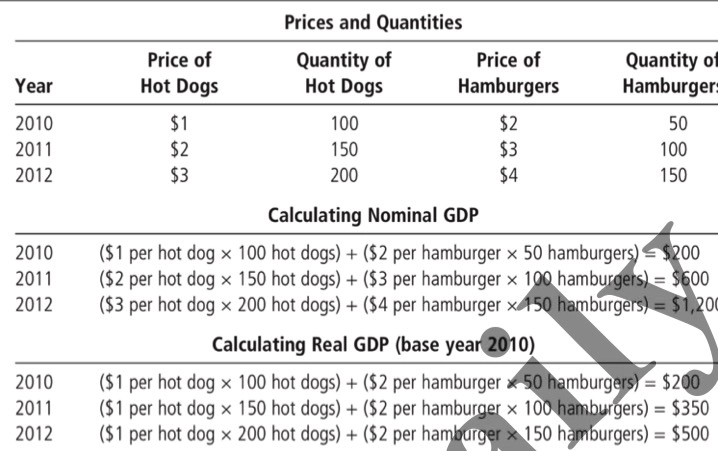

GDP

- \(\text{Expenditure = Income}\)

- 自家制造的非售卖商品不计入

- 非法生产(毒品,嫖娼)不计入

- 最终计入,零部件组成不计入(不重复计算)

- 只计入生产年份的,售卖年份不重要

- 只用管是否在本国境内生产,不关系生产者国籍

- 在一段时间内计算,通常是一年

- Real GDP

- \(C + I + G + N_x\)

- Consumption

- Investment

- Government

- Exclude Transfer Pay

- Net Export

- Evaluate by Income or Expenditure

- Don’t repeat value-adding of same parts

- Exclude effects of inflation or deflation

- Base year

- \(C + I + G + N_x\)

- Nominal GDP

- affects by inflation and deflation

- GDP Deflator

- \(\text{GDP Deflator} = \frac {\text{Nominal GDP}}{\text{Real GDP}}, \text{Real GDP} = \frac {\text{Nominal GDP}}{\text{GDP Deflator}}\)

- \(\text{GDP Deflator} = \frac {\text{Price}}{\text{Base Year Price}}\)

- Reflect inflation level and price level

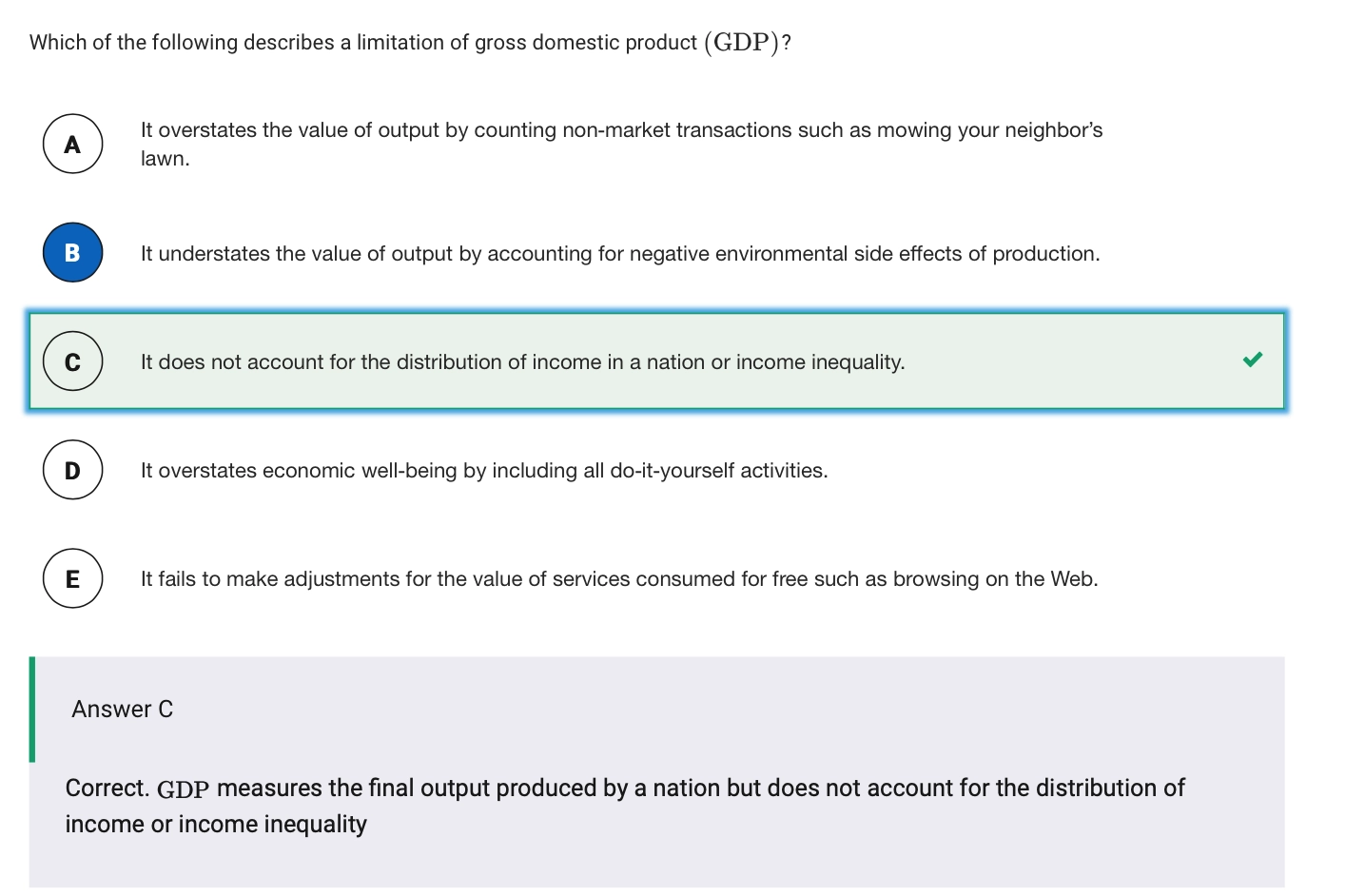

- Could not reflect the whole image of the country economic development

CPI

- \(\frac{\text{Price of basket of goods in current year}}{\text{Price of basket in base year}}\)

- Inflation Rate

- \(\frac {\text{CPI in Year 2 - CPI in Year

1}}{\text{CPI in Year 1}}\)

- rate of change of CPI

- \(\frac {\text{CPI in Year 2 - CPI in Year

1}}{\text{CPI in Year 1}}\)

- Underestimate cost living and overestimate inflation rate

- Only reflect products in the basket

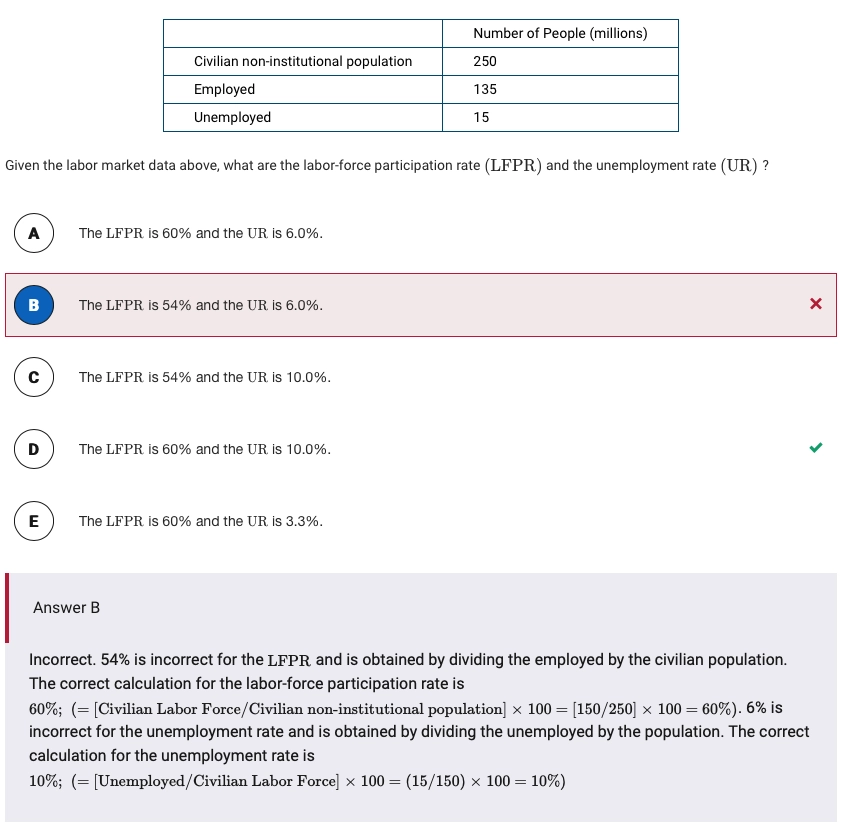

Unemployment

- Laborforce

- Employed

- Full time or part time job

- Unemployed

- Available for work

- Actively looking for job

- Employed + unemployed

- Labor force excludes the people who do not actively seek a job (Discourage worker).

- Labor force participation rate

- \(\frac {\text{Labor force}}{\text{Adult population}}\)

- Unemployed rate

- \(\frac {\text{Unemployed Population}}{\text{Labor force}}\)

- Employed

- Type of Unemployment

- Nature Unemployment

- Frational

- People move between different type of job.

- 摩擦性失业: 人工在不同的工作中转移,转业,就业所产生的失业现象。例如刚毕业的大学生就是暂时处于摩擦性失业,刚刚辞职正在寻找下一份工作的工人也处于摩擦性失业。

- Structural

- Some jobs are eliminated by market natural selection.

- 结构性失业: 由于经济结构发生变化导致工作岗位的数量不足以为所有想要这个工作的人提供工作机会。同理,因为有最低工资限制,供大于求,导致劳动力过多,或者由于工人的技艺不再符合市场需要被淘汰后导致的失业。

- Seasonally

- Fruit, Travel, etc.

- 季节性失业 :由于部内间歇性生产特征引起的失业。 例如冬天停业的水上乐园,农民只在固定季节播种和收割。

- Frational

- Cyclically

- Demand decrease, Recession

- 周期性失业:由于整个经济体的状况导致产量需求下降,经济萧条,从而引起的短期失业。只有周期性失业可以通过人为来调整。

- Nature Unemployment

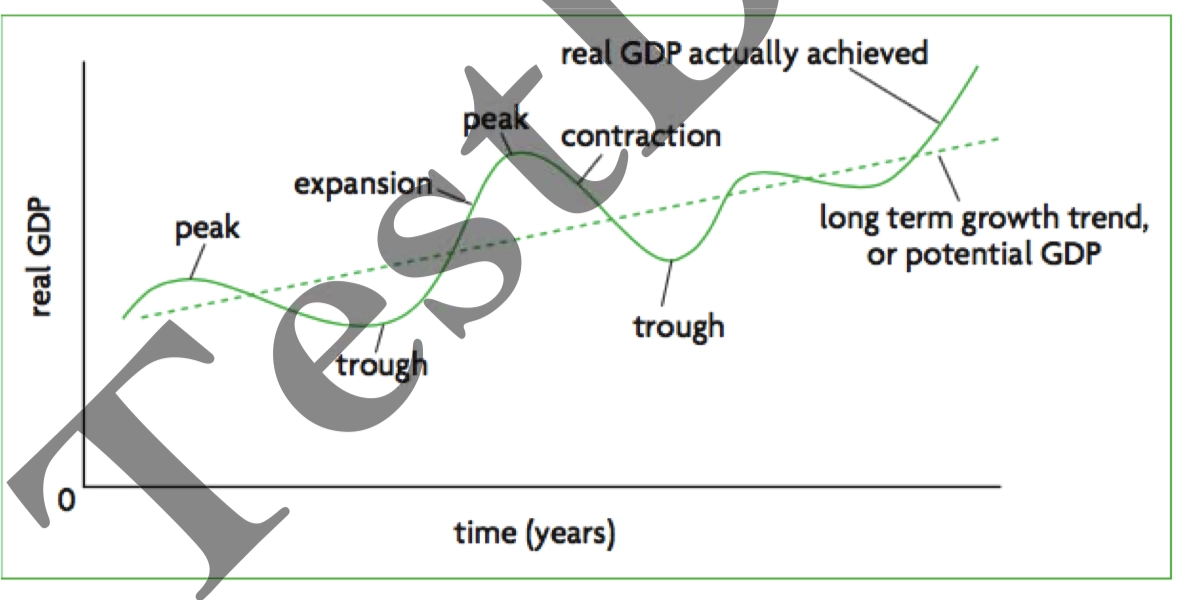

Business Cycle

- Overheated - over real GDP

- Recession - under real GDP

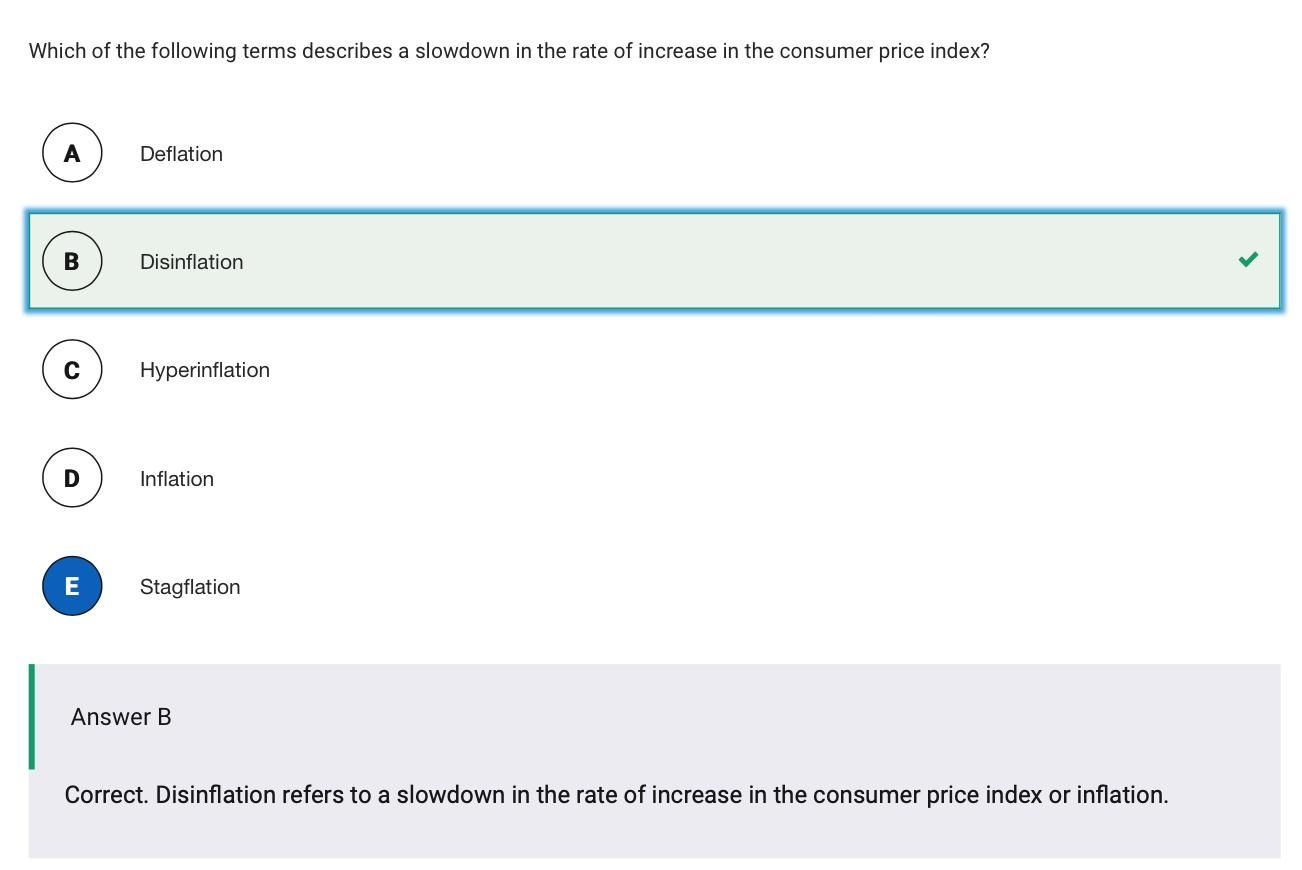

- Disinflation refers to a slowdown in the rate of increase in the consumer price index or inflation.

Example

The Circular Flow and GDP

Limitations of GDP

Unemployment

Costs of Inflation

Business Cycles

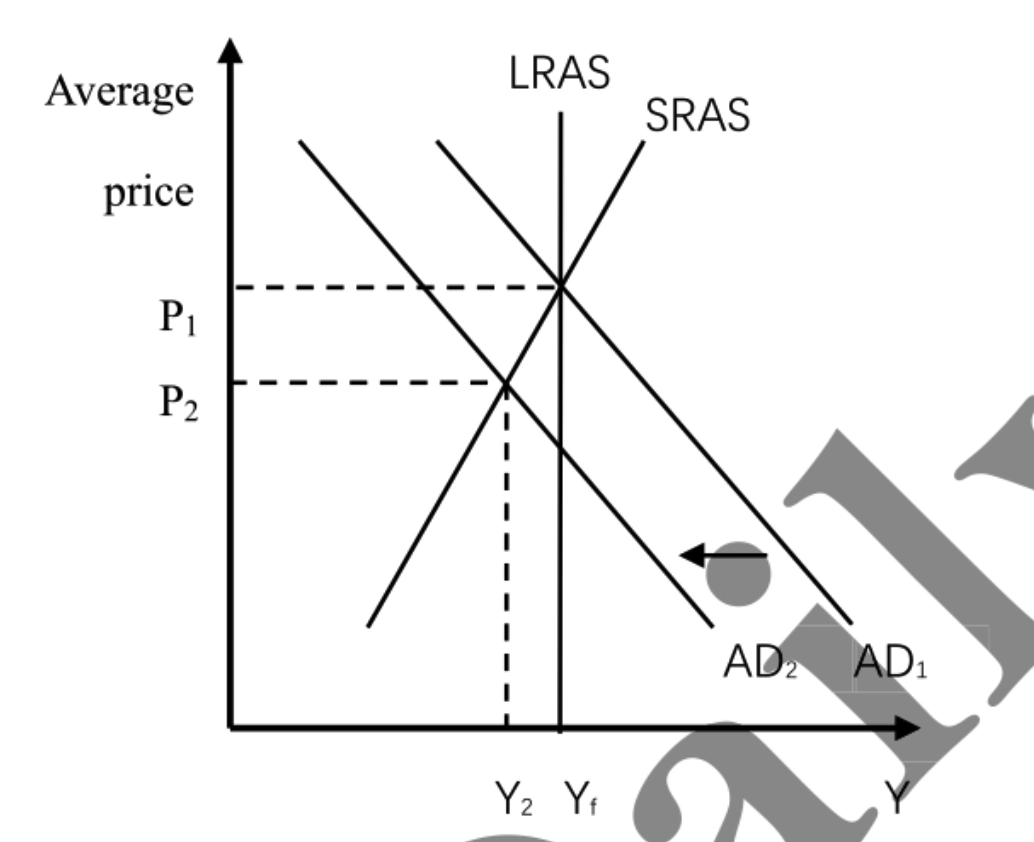

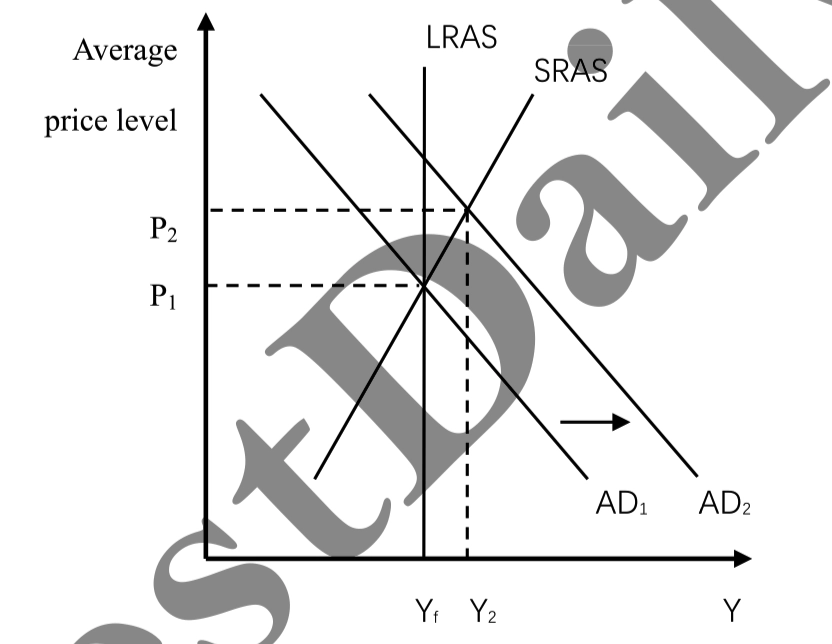

Unit 3: National Income and Price

AD - AS Model

- Aggregate Demand

- Wealth Effect

- Price level increase → Fixed amount money purchasing power decrease → Expenditure decrease → Real GDP decrease

- Wealth Effect

- Aggregate Supply

- Long term

- Real GDP

- Does not be affected by inflation or price level

- Affect by labor force, capital, technology, natural resources

- Real GDP

- Short term

- Sticky Wage

- The labor contract stipulating wages would not change in a period of time and do not change with the change of inflation rate

- Price level increase → Per unit labor cost decrease → Recruit more labors → Increase output

- Sticky Wage

- Curve shifting is determined by the events whether are positive or negative for firms

- Long term

- Cost-Push Inflation, SRAS Shift to Left

- Demand-Pull Inflation , AD Shift to Right

Fiscal Policy

- Reason

Recessionary Gap, we need to shift to right

- Expansionary Fiscal Policy

Inflationary Gap, we need to shift to left

- Deflationary Fiscal Policy

- Tools

- Government Spending

- \(\text{Spending = Household Income}\)

- Multiplier

- \(\frac {1}{1 - \text{MPC}}\)

- \(\frac 1{\text{MPS}}\)

- Bond Interest Rate = Bond Coupon Payment / Bond Price

- Tax

- Multiplier

- \(\frac {\text{MPC}}{1 - \text{MPC}}\)

- \(\frac{\text{MPC}}{\text{MPS}}\)

- Multiplier

- Government Spending

- Stagflation

AS shifts to left

- Deflationary Fiscal Policy, but still low output(high unemployment rate)

- Automatic Stabilizers

- Fixed Progressive Tax → Inflation, high tax → Deflation, low tax

- Balance Budget

- Government spending multiplier → tax multiplier

Unit 4-5: Financial Sector

Money

- Feature

- Medium of exchange

- Unit of account

- Store of value

- Liquidity

- Standard for deferred payment

- Type

- Commodity Money

- Gold

- Fiat Money

- CNY, USD

- \(\text{M1 = Demand Deposits}\)

- \(\text{M2 = M1 + Saving Deposits}\)

- Stock

- Firm Ownership, Profit

- Bond

- Fixed interest

- Commodity Money

Financial System

Commercial bank

- Bank Reserves

- Reserve ratio: \(\frac{\text{Bank reserve}}{\text{Total deposit}}\)

- \(\frac {\text{Min reserve requirement}}{\text{Total deposit}}\)

- Excess Reserve: \(\text{min reserve} - \text{bank reserve}\)

- Balance Sheet

- \(\text{Total Assets = Total Liabilities}\)

- Bank Reserves

Money Multiplier

- \(\frac 1{\text{RRR}}\)

- \(\text{M2} = \text{M1} \times \frac {1}{\text{RRR}}\)

- 不能完全满足货币乘数的原因:cash leakage (钱不会回存)

Money Market

- MD

- Interest rate increase → quantity decrease

- MS

- Determine by federal reserve

- Fisher Effect: Real Interest Rate = Nominal Interest Rate - Inflation Rate

- MD

Federal Reserve

- Monetary Policy

- RRR

- RRR increase → Reserves increase → Money Supply decrease → Interest rate increase

- Discount rate

- Discount rate increase → less bank loan from central bank → Money Supply decrease → Interest rate increase

- Open market Operations

- Purchase bond → Money Supply Increase → Interest rate decrease

- RRR

- \(\text{Money Suppy} \times \text{Money Velocity}= \text{Price Level} \times \text{Yield} = \text{Nominal GDP}\)

- Monetary Policy

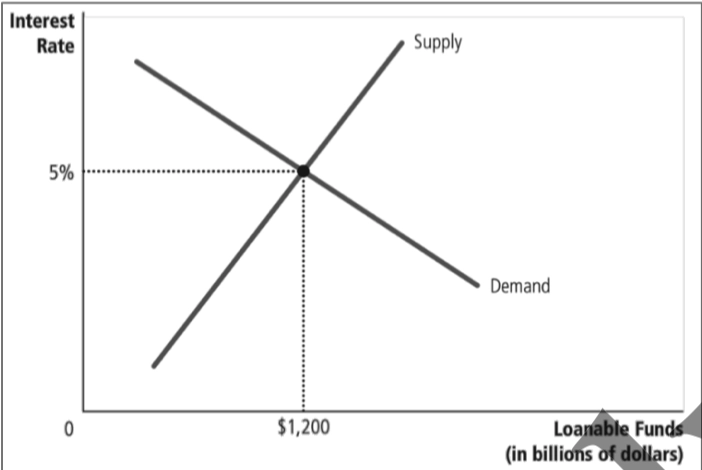

Loanable Funds Market

- Crowding Out Effect

- Recession Gap → Government Expansionary Fiscal Policy → Increase Government Spending → Increase Government Borrowing → Demand of Loan Shift to Right Dramatically → Firms, Individual Reduce Borrowing

- Crowding Out Effect

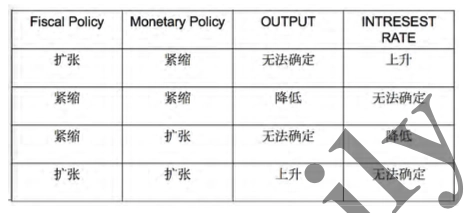

- Mix Policy

- 同向改变产量,异向改变利率

- Phillips Curve

- Short Run: Inflation Increase → Unemployment Decrease

- SRAS Shift → Curve Shift

- SRAS Left Shift → Curve Out Shift

- SRAS Right Shift → Curve In Shift

- AD Shift → Point Shift

- Long Run = Natural Unemployment

Unit 6: International Trade and Finance

- Current Account 经常账户

- 国际进出口交易

- Capital Account 资本账户

- 国际资产交易

- Current Account + Capital Account = 0